Instructions for Side by Side Printing

- Print the notecards

- Fold each page in half along the solid vertical line

- Cut out the notecards by cutting along each horizontal dotted line

- Optional: Glue, tape or staple the ends of each notecard together

BUA 350 Exam #2

front 1 What is the standard deviation for an average stock? | back 1 ~35% |

front 2 For virtually all portfolios, the riskiness of the portfolio is a weighted average of the riskiness of the individual assets in the portfolio with the weights equal to the fraction of the total portfolio funds invested in each asset.

| back 2 B. False

|

front 3 Do most stocks have positive, negative, or zero correlations with each other? | back 3 Positive |

front 4 What is correlation of any security with riskless asset? | back 4 Zero |

front 5 Correlation coefficients (p) range from … | back 5 -1 to +1 |

front 6 Correlation coefficient (p) of -1 implies... | back 6 perfectly negative correlation |

front 7 Correlation coefficient (p) of +1 implies... | back 7 perfectly positive correlation |

front 8 Correlation coefficient (p) of 0 implies... | back 8 variables are not related |

front 9 Why is the T-bill return independent of the economy? Do T-bills promise a completely risk-free return? | back 9

|

front 10 Describe the correlations of these two graphs | back 10 Left graph - perfectly positively correlated returns (p = +1) Right graph - perfectly negatively correlated returns (p = -1) |

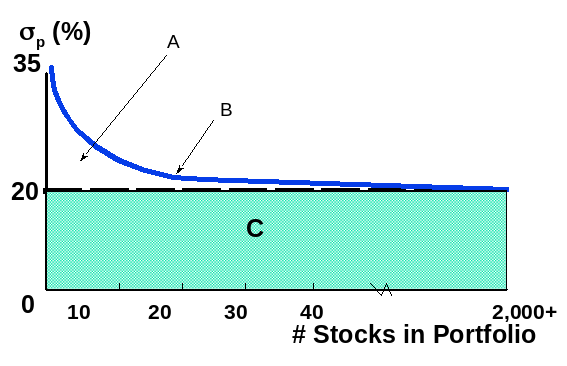

front 11 What effect does adding stocks have on:

| back 11

|

front 12 After about ________stocks, the diversification benefits of adding more stocks dissipates | back 12 40 |

front 13

| back 13

|

front 14

| back 14

|

front 15  Label the following graph | back 15

|

front 16

| back 16

|

front 17 If an investor chooses to hold a one-stock portfolio (exposed to more risk than a diversified investor), would the investor be compensated for the risk they bear? | back 17

|

front 18 Do most stocks have positive, negative or zero betas? | back 18 Positive Market beta is 1 by definition |

front 19

(all the answers are numbers) | back 19

|

front 20 For a beta of +2, if …

| back 20

|

front 21 Which of the following statements are correct?

| back 21 D - Diversifiable risk can be eliminated by proper diversification, while market risk cannot be eliminated by proper diversification.

|

front 22 Which of the following statements best describes what would be expected to happen as you randomly add stocks to your portfolio?

| back 22 A - If stock returns are not perfectly correlated, adding more stocks to your portfolio should reduce the portfolio’s company specific risk.

|

front 23 ___________ is a measure of market risk which is the extent to which the returns on a stock move with the market.

| back 23 A - Correct. Beta is a measure of market risk which is the extent to which the returns on a stock move with the market. |

front 24 What is the proxy for the risk-free rate? | back 24 U.S. Treasury Bills |

front 25 What is the proxy for the return on the market? | back 25 Typically use the S&P500 Index |

front 26 What is the typical range for the market risk premium? | back 26 4-8% per year |

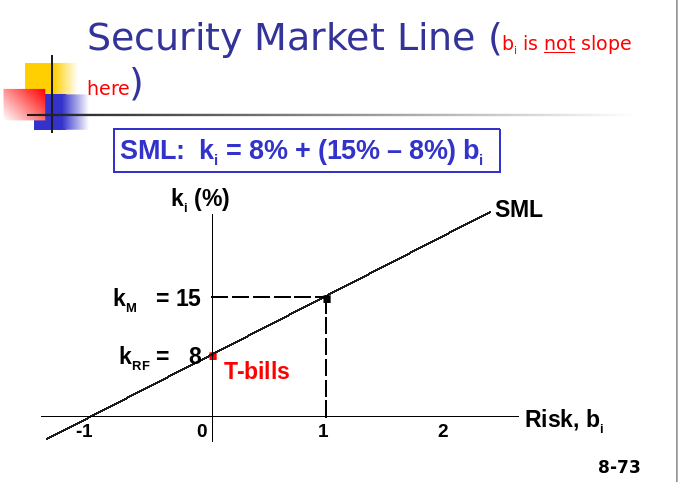

front 27  What is the slope of this line, and what does it represent? | back 27 7% Risk premium |

front 28 What happens to prices if investors raise inflation expectations by 3%? | back 28 Reqd return on all risky assets increases by 3%, Prices drop If Expected Return increases ->Current Price

drops |

front 29 What happens to price if investors’ risk aversion increased, causing the market risk premium to increase by 3% (rise/run=3/1)? | back 29 Prices of high Beta stocks drop more km rises from 15 to 18%, so ki for b=.5 rises by 1.5%, and for b=2 rises by 6%, delta Rf =0 |

front 30 Changes in SML impact riskier stocks more.

| back 30 A |

front 31 Does a higher required return mean that the actual return you get will be higher? | back 31 No, may lose all of your money on a stock, because Realized Return does not equal Expected Return |

front 32 A high beta port will generate high returns only if _______ is high. | back 32 Rm |

front 33 Investors’ required returns are based on future risk, but betas are calculated with historical data. Will a company’s beta be the same this year and next year? | back 33

|

front 34 The CAPM says that the relevant risk of an individual asset is its:

| back 34 D - The CAPM say that the relevant risk of an individual asset is its contribution to the risk of a well-diversified portfolio (its portfolio or market risk). How the addition of a stock to the portfolio alters its Beta. The rest is diversified away. |

front 35 Which of the following statements is correct?

| back 35 D |

front 36 Stock A has a beta of 1.0 and Stock B has a beta of 0.8. Which of the following statements must be true about these securities? (Assume the market is in equilibrium.)

| back 36 D - In equilibrium, Stock A will have a higher expected return to compensate for the additional market risk.

|

front 37 Is it possible to construct a portfolio of real-world stocks that has a required return equal to the risk-free rate? Explain. | back 37 Yes, if the portfolio’s beta is equal to zero. In practice, however, it may be impossible to find individual stocks that have a nonpositive beta. In this case it would also be impossible to have a stock portfolio with a zero beta. Even if such a portfolio could be constructed, investors would probably be better off just purchasing Treasury bills, or other zero beta investments. |

front 38 Stock A has an expected return of 7%, a standard deviation of expected returns of 35%, a correlation coefficient with the market of −0 3, and a beta coefficient of −0 5. Stock B has an expected return of 12%, a standard deviation of returns of 10%, a 0 7 correlation with the market, and a beta coefficient of 1 0. Which security is riskier? Why? | back 38 Security A is less risky if held in a diversified portfolio because of its negative correlation with other stocks. In a single-asset portfolio, Security A would be more risky because σA > σ B and CVA > CVB. |

front 39 A stock had a 12% return last year, a year when the overall stock market declined. Does this mean that the stock has a negative beta and thus very little risk if held in a portfolio? Explain. | back 39 No. For a stock to have a negative beta, its returns would have to logically be expected to go up in the future when other stocks’ returns were falling. Just because in one year the stock’s return increases when the market declined doesn’t mean the stock has a negative beta. A stock in a given year may move counter to the overall market, even though the stock’s beta is positive. |

front 40 If a company's beta were to double, would its required return also double? | back 40 According to the Security Market Line (SML) equation, an increase in beta will increase a company’s expected return by an amount equal to the market risk premium times the change in beta. For example, assume that the risk-free rate is 6%, and the market risk premium is 5%. If the company’s beta doubles from 0.8 to 1.6 its expected return increases from 10% to 14%. Therefore, in general, a company’s expected return will not double when its beta doubles. |

front 41 Given the following information, determine the beta coefficient for Stock J that is consistent with equilibrium: rJ = 12.5%, rRF = 4.5%, rM = 10.5%. | back 41 In equilibrium: rJ = rJ = 12.5%. rJ = rRF + (rM – rRF)b 12.5% = 4.5% + (10.5% – 4.5%)b b = 1.33 |

front 42 Stock R has a beta of 1.5, Stock S has a beta of 0.75, the required return on an average stock is 13%, and the risk-free rate of return is 7%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? | back 42 We know that bR = 1.50, bS = 0.75, rM = 13%, rRF = 7%. ri = rRF + (rM – rRF)bi = 7% + (13% – 7%)bi. rR = 7% + 6%(1.50) = 16.0% rS = 7% + 6%(0.75) = 11.5 16.0% - 11.5% = 4.5% |

front 43 Bradford Manufacturing Company has a beta of 1.45, while Farley Industries has a beta of 0.85. The required return on an index fund that holds the entire stock market is 12.0%. The risk-free rate of interest is 5%. By how much does Bradford’s required return exceed Farley’s required return? | back 43 An index fund will have a beta of 1.0. If rM is 12.0% (given in the problem) and the risk-free rate is 5%, you can calculate the market risk premium (RPM) calculated as rM – rRF as follows: r = rRF + (RPM)b 12.0% = 5% + (RPM)1.0 7.0% = RPM Required Return = RRF + (RPM ) x

beta |

front 44 Calculate the required rate of return for Manning Enterprises, assuming that investors expect a 3.5% rate of inflation in the future. The real risk-free rate is 2.5% and the market risk premium is 6.5%. Manning has a beta of 1.7, and its realized rate of return has averaged 13.5% over the past 5 years. | back 44 rRF = r* + IP = 2.5% + 3.5% = 6%. rs = 6% + (6.5%)1.7 = 17.05%. |

front 45 Suppose rRF=9%, rM=14%, and bi=1.3. What is ri, the required rate of return on Stock i ? | back 45 ri = rRF + (rM – rRF)bi = 9% + (14% – 9%)1.3 = 15.5%. |

front 46 Suppose rRF=9%, rM=14%, and bi=1.3. Now suppose that rRF (1) increases to 10% or (2) decreases to 8%. The slope of the SML remains constant. How would this affect rM and ri ? | back 46 1. rRF increases to 10%: rM increases by 1 percentage point, from 14% to 15%. ri = rRF + (rM – rRF)bi = 10% + (15% – 10%)1.3 = 16.5%. 2. rRF decreases to 8%: rM decreases by 1%, from 14% to 13%. ri = rRF + (rM – rRF)bi = 8% + (13% – 8%)1.3 = 14.5%. |

front 47 Suppose rRF=9%, rM=14%, and bi=1.3. Now assume that rRF remains at 9% but rM (1) increases to 16% or (2) falls to 13%. The slope of the SML does not remain constant. How would these changes affect ri ? | back 47 1. rM increases to 16%: ri = rRF + (rM – rRF)bi = 9% + (16% – 9%)1.3 = 18.1%. 2. rM decreases to 13%: ri = rRF + (rM – rRF)bi = 9% + (13% – 9%)1.3 = 14.2%. |

front 48 Consider the following information for three stocks, Stocks X, Y, and Z. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.). Fund P has half of its funds invested in Stock X and half invested in Stock Y. Fund Q has one-third of its funds invested in each of the three stocks. The risk-free rate is 5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) What is the market risk premium ( r M - r RF )? | back 48 Using Stock X (or any stock): 9% = rRF + (rM – rRF)bX 9% = 5.5% + (rM – rRF)0.8 (rM – rRF) = 4.375%. |

front 49 Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. Calculate each stock's coefficient of variation. | back 49 rx = 10%; bX = 0.9; σX = 35%. ry = 12.5%; bY = 1.2; σY = 25%. rRF = 6%; RPM = 5%. CVX = 35%/10% = 3.5. CVY = 25%/12.5% = 2.0. |

front 50 Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. Which stock is riskier for a diversified investor? | back 50 For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is more risky. Stock Y has the higher beta so it is more risky than Stock X. |

front 51 Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. Calculate each stock's required rate of return. On the basis of the two stock's expected and required returns, which stock would be more attractive to a diversified investor? | back 51 rX = 6% + 5%(0.9) = 10.5%. rY = 6% + 5%(1.2) = 12%. Stock Y would be most attractive to a diversified investor since its expected return of 12.5% is greater than its required return of 12%. |

front 52 Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. Calculate the required return of a portfolio that has$7,500 invested in Stock X and $2,500 invested in Stock Y? | back 52 bp = ($7,500/$10,000)0.9 + ($2,500/$10,000)1.2 = 0.6750 + 0.30 = 0.9750. rp = 6% + 5%(0.975) = 10.875%. |

front 53 Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. If the market risk premium increased to 6 percent, which of the two stocks would have the larger increase in its requiredreturn? | back 53 If RPM increases from 5% to 6%, the stock with the highest beta will have the largest increase in its required return. Therefore, Stock Y will have the greatest increase. Check: rX = 6% + 6%(0.9) = 11.4%. Increase 10.5% to 11.4%. rY = 6% + 6%(1.2) = 13.2%. Increase 12% to 13.2%. |

front 54 The values of outstanding bonds change whenever the going rate of interest changes. In general, short-term interest rates are more volatile than long-term interest rates. Therefore, short-term bond prices are more sensitive to interest rate changes than are long-term bond prices. Is that statement true or false? Explain. (Hint: Make up a "reasonable" example based on a 1-year and a 20-year bond to help answer the question.) | back 54 False. Short-term bond prices are less sensitive than long-term bond prices to interest rate changes because funds invested in short-term bonds can be reinvested at the new interest rate sooner than funds tied up in long-term bonds. For example, consider two bonds, both with a 10% annual coupon and a $1,000 par value. The only difference between them is their maturity. One bond is a 1-year bond, while the other is a 20-year bond. Consider the values of each at 5%, 10%, 15%, and 20% interest rates. 1-year 20-year 5% $1,047.62 $1,623.11 10% 1,000.00 1,000.00 15% 956.52 687.03 20% 916.67 513.04 As you can see, the price of the 20-year bond is much more volatile than the price of the 1-year bond. |

front 55 If interest rates rise after a bond issue, what will happen to the bond's price and YTM? Does the time to maturity affect the extent to which interest rate changes affect the bond's price? (Again, an example might help you answer this question.) | back 55 The price of the bond will fall and its YTM will rise if interest rates rise. If the bond still has a long term to maturity, its YTM will reflect long-term rates. Of course, the bond’s price will be less affected by a change in interest rates if it has been outstanding a long time and matures shortly. While this is true, it should be noted that the YTM will increase only for buyers who purchase the bond after the change in interest rates and not for buyers who purchased previous to the change. If the bond is purchased and held to maturity, the bondholder’s YTM will not change, regardless of what happens to interest rates. For example, consider two bonds with an 8% annual coupon and a $1,000 par value. One bond has a 5-year maturity, while the other has a 20-year maturity. If interest rates rise to 15% immediately after issue the value of the 5-year bond would be $765.35, while the value of the 20-year bond would be $561.85. |

front 56 Assume that you have a short investment horizon (less than 1 year). You are considering two investments: a 1-year Treasury security and a 20-year Treasury security. Which of the two investments would you view as being riskier? Explain. | back 56 As an investor with a short investment horizon, I would view the 20-year Treasury security as being more risky than the 1-year Treasury security. If I bought the 20-year security, I would bear a considerable amount of interest rate risk. Since my investment horizon is only one year, I would have to sell the 20-year security one year from now, and the price I would receive for it would depend on what happened to interest rates during that year. However, if I purchased the 1-year security I would be assured of receiving my principal at the end of that one year, which is the 1-year Treasury’s maturity date. |

front 57 Will the following increase or decrease a bond's yield to maturity: The bond's price increases. | back 57 If a bond’s price increases, its YTM decreases. |

front 58 Will the following increase or decrease a bond's yield to maturity: The bond is downgraded by the rating agencies. | back 58 If a company’s bonds are downgraded by the rating agencies, its YTM increases. |

front 59 Will the following increase or decrease a bond's yield to maturity: A change in the bankruptcy code makes it more difficult for bondholders to receive payments in the event the firm declares bankruptcy. | back 59 If a change in the bankruptcy code made it more difficult for bondholders to receive payments in the event a firm declared bankruptcy, then the bond’s YTM would increase. |

front 60 Will the following increase or decrease a bond's yield to maturity: The economy seems to be shifting from a boom to a recession. Discuss the effects of the firm's credit strength in your answer. | back 60 If the economy entered a recession, then the possibility of a firm defaulting on its bond would increase; consequently, its YTM would increase. |

front 61 Will the following increase or decrease a bond's yield to maturity: Investors learn that the bonds are subordinated to another debt issue. | back 61 If a bond were to become subordinated to another debt issue, then the bond’s YTM would increase. |

front 62 Callaghan Motors bonds have 10 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 8%, and the yield to maturity is 9%. What is the bond's current market price? | back 62 With your financial calculator, enter the following: N = 10; I/YR = YTM = 9%; PMT = 0.08 ´ 1,000 = 80; FV = 1000; PV = VB = ? PV = $935.82. |

front 63 A bond has a $1,000 par value , 10 years to maturity, and a 7% annual coupon and sells for $985. What is its yield to maturity? | back 63 VB = $985; M = $1,000; Int = 0.07 ´ $1,000 = $70. Current yield = Annual interest/Current price of bond = $70/$985.00 = 7.11%. |

front 64 A bond has a $1,000 par value , 10 years to maturity, and a 7% annual coupon and sells for $985. Assume that the yield to maturity remains constant for the next 3 years. What will the price be 3 years from today? | back 64 For N = 10; PV = -985; PMT = 70; FV = 1000; YTM = ? Solve for I/YR = YTM = 7.2157% » 7.22%. Now, N = 7 [7 yrs remaining]; I/YR = 7.2157; PMT = 70; FV = 1000; PV = ? Solve for VB = PV = $988.46. |

front 65 Nungesser Corporation's outstanding bonds have a $1,000 par value, a 9% semiannual coupon, 8 years to maturity, and a 8.5% YTM. What is the bond's price? | back 65 The problem asks you to find the price of a bond, given the following facts: N = 2 ´ 8 = 16; I/YR = 8.5/2 = 4.25; PMT = 45; FV = 1000. With a financial calculator, solve for PV = $1,028.60. |

front 66 Last year Joan purchased a $1,000 face value corporate bond with an 11% annual coupon rate and a 10-year maturity. At the time of purchase, it had an expected yield to maturity if 9.79%. If Joan sold the bond today for $1,060.90, what rate of return would she have earned for the past year? | back 66 First, we must find the price Joan paid for this bond. N = 10, I/YR = 9.79, PMT = 110, FV = 1000 PV = -$1,075.02. VB = $1,075.02. Then to find the one-period return, we must find the sum of the change in price and the coupon received divided by the starting price. One-period return = (Ending price - Beginning price + Coupon received) / Beginning price One-period return = ($1,060.49 – $1,075.02 + $110)/$1,075.02 One-period return = 8.88%. |

front 67 Explain whether the following statement is true or false: $100 a year for 10 years is an annuity; but $100 in Year 1, $200 in Year 2, and $400 in Years 3 through 10 does not constitute an annuity. However, the second series contains an annuity. | back 67 True. The second series is an uneven cash flow stream, but it contains an annuity of $400 for 8 years. The series could also be thought of as a $100 annuity for 10 years plus an additional payment of $100 in Year 2, plus additional payments of $300 in Years 3 through 10. |

front 68 If a firm's earnings per share grew from $1 to $2 over a 10-year period, the total growth would be 100%, but the annual growth rate would be less than 10%. True or false? Explain. (Hint: If you aren't sure, plug in some numbers and check it out.) | back 68 True, because of compounding effects—growth on growth. The following example demonstrates the point. The annual growth rate is I in the following equation: $1(1 + I)10 = $2. We can find I in the equation above as follows: Using a financial calculator input N = 10, PV = -1, PMT = 0, FV = 2, and I/YR = ? Solving for I/YR you obtain 7.18%. Viewed another way, if earnings had grown at the rate of 10% per year for 10 years, then EPS would have increased from $1.00 to $2.59, found as follows: Using a financial calculator, input N = 10, I/YR = 10, PV = -1, PMT = 0, and FV = ?. Solving for FV you obtain $2.59. This formulation recognizes the “interest on interest” phenomenon. |

front 69 Would you rather have a savings account that pays 5% interest compounded semiannually or one that pays 5% interest compounded daily? Explain. | back 69 For the same stated rate, daily compounding is best. You would earn more “interest on interest.” |

front 70 If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years? | back 70 FV5 = $10,000(1.10)5 = $10,000(1.61051) = $16,105.10. Alternatively, with a financial calculator enter the following: N = 5, I/YR = 10, PV = -10000, and PMT = 0. Solve for FV = $16,105.10. |

front 71 What is the present value of an investment security that will pay $5,000 in 20 years if securities of equal risk available on the market pay 7% annually? | back 71 With a financial calculator enter the following: N = 20, I/YR = 7, PMT = 0, and FV = 5000. Solve for PV = $1,292.10. |

front 72 Your parents will retire in 18 years. They currently have $250,000, and they think that they will need $1,000,000 at retirement. What interest rate must they earn to reach their goal (assuming they will not save any additional funds)? | back 72 With a financial calculator enter the following: N = 18, PV = -250000, PMT = 0, and FV = 1000000. Solve for I/YR = 8.01% ≈ 8%. |

front 73 If you deposit money today in an account that pays 6.5% annual interest, how long will it take to double your money? | back 73 Time to double your money: Rule of 72 (72/6.5=11yrs, 72/11=6.5%) 2 = 1(1.065)n. With a financial calculator enter the following: I = 6.5, PV = -1, PMT = 0, and FV = 2. Solve for N = 11.01 ≈ 11 years |

front 74 You have $42,180.53 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $250,000. You expect to earn 12% annually on the account. How many years will it take to reach your future goal? | back 74 Using your financial calculator, enter the following data: I/YR = 12; PV = ‑42180.53; PMT = ‑5000; FV = 250000; N = ? Solve for N = 11. It will take 11 years to accumulate $250,000. |

front 75 What is the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this were an annuity due, what would its future value be? | back 75 With a financial calculator enter the following: N = 5, I/YR = 7, PV = 0, and PMT = 300. Solve for FV = $1,725.22. With a financial calculator, switch to “BEG” and enter the following: N = 5, I/YR = 7, PV = 0, and PMT = 300. Solve for FV = $1,845.99. Don’t forget to switch back to “END” mode. |

front 76 What do we call the value of a cash flow today? | back 76 Present Value or Principal |

front 77 Let’s say you have $100 in an account which earns 10 % annually. How much would you have after one year? | back 77 Take $100 and multiply by 1.10 = $100 (1.10) = $110 |

front 78 Let’s say you have $100 in an account which earns 10 % annually. How much would you have after two years?? | back 78 $110 (1.10) = $100 (1.10)(1.10) = $100 (1.10)2 |

front 79 You put $1000 into a retirement account paying 8% annually for 37 years. What do you end up with? | back 79 FV37 = 1000(1.08)37 = $17,245.63 |

front 80 You invest $300 in an account paying 11% interest. How much will you have in 6 years? | back 80 $561.12 |

front 81 You put $400 into an account that pays 8 % interest compounded annually, quarterly.

| back 81 a. $643.37 b. = $646.40 See Chapter 5, slide 2-16 for explanation |

front 82 Will the FV of a lump sum be larger or smaller if compounded more often, holding the stated I% constant? | back 82 LARGER, as the more frequently compounding occurs, interest is earned on interest more often |

front 83 What is the future value for $100 @ 10% for 3 years.

| back 83

See Chapter 5, slide 2-17 for explanation |

front 84 The effective rate (ieff) will always be ________(lesser/greater) than the nominal rate if the compounding frequency is greater than one time per year | back 84 greater |

front 85 The ______ rate is commonly called the annual percentage rate (or APR) | back 85 nominal |

front 86 The ______ rate is commonly called the annual percentage yield (or APY) | back 86 effective annual rate (true rates) |

front 87 _______ rates - contractual rates of interest charged by a lender or promised by a borrower | back 87 nominal rates (APR) |

front 88 _______ rates - rates of interest actually paid or earned | back 88 Effective annual rates (true rates) (APY) |

front 89

| back 89

|

front 90 What is the EAR for a simple rate of 10%, compounded semi-annually? | back 90 10.25% See chapter 5, slide 2-21 for explanation |

front 91 What is the effective annual rate of 12%, compounded monthly? | back 91 [1+.12/12]^12-1 = EAR = 12.68% |

front 92 What is the effective annual rate of 12%, compounded daily? | back 92 [1+.12/365]^365-1 = EAR = 12.75% |

front 93 Can the effective rate ever be equal to the nominal rate? | back 93

|

front 94 Suppose you put $100 in your account every year for 3 years, earning 7% interest. How much would you have after the 3 years? | back 94 $321.49 3 years $100 ordinary annuity |

front 95 Suppose you put $100 in your account every year for 3 years, earning 7% interest. How much would you have after the 3 years? | back 95 You must calculate each payment separately because they have been in the account for a different number of years. FV3 = 100(1.07)2 + 100(1.07)1 + 100 FV3 = $321.49 ALSO PV3=$262.43, when FV=0 Chapter 5, slide 2-26 |

front 96 What is the difference between an ordinary annuity and an annuity due? | back 96

|

front 97 Suppose you need $20,000 in three years to buy your new hybrid car. If you can earn 8% on your money, how much do you need today? | back 97 PV = 20,000 / (1.08)3 = $15,876 Chapter 5, slide 2-31 |

front 98 What happens to PV if the interest rate is increased?? | back 98 It decreases |

front 99 What happens to PV if the investment term increases?? | back 99 It decreases |

front 100 Suppose you want to have enough money in your bank account to withdraw $800 at the end of each year for three years in order to pay tuition. How much money should you have in the account now if you can earn 9% interest?? | back 100 $2,025.04 Chapter 5, slide 2-34 |

front 101 Suppose you need $15,000 in 20 years to pay for a ski trip. If you can earn 9% on your money, how much do you need today [lump sum]? | back 101 $2676.46 today Chapter 5, slide 2-35 |

front 102 Suppose you need $15,000 in 20 years to pay for a ski trip. If you can earn 9% on your money, how much do you need to deposit annually? | back 102 $293.20/yr Chapter 5, slide 2-35 |

front 103 Suppose you need $15,000 in 20 years to pay for a ski trip. If you can earn 9% on your money, compounded monthly, how much do you need today [lump sum]? | back 103 $2496.19 Chapter 5, slide 2-36 |

front 104 Suppose you need $15,000 in 20 years to pay for a ski trip. If you can earn 9% on your money, compounded monthly, how much do you have to deposit monthly for 20 years? | back 104 $22.46/mo |

front 105 A(n) ___________ is a series of fixed payments at regular intervals that continue forever. | back 105 perpetuity |

front 106 If you are going to get infinite cash flows with a perpetuity, shouldn’t the PV be infinite? | back 106 No (Principal is never touched. Take the entire interest earned each period.) |

front 107 You would like to put $500 per year aside [-ve] for 30 years and reach your goal of $250,000. What annual rate of return do you need to earn? [pv=0, why?] ] | back 107 15.70% Chapter 5, slide 2-42 |

front 108 What interest rate do you need to earn to double your money in three years? [pmt=0, why?] ] | back 108 25.99% Chapter 5, slide 2-42 |

front 109 You borrow $20,000 [+ve] . Your loan requires you to make 5 annual payments [-ve] of $5,000 each. What is the rate on the loan? [fv=0, why?] | back 109 7.93% Chapter 5, slide 2-42 |

front 110 You borrow $30,000 for a new car at 8% interest for 3 years. What is your monthly car payment? | back 110 $940.00 Iper=8/12, N =36, FV=0 |

front 111 You borrow $300,000 for your new house at 7% interest for 30 years. What is your monthly house payment? | back 111 $1,995.91 i/y=7/12, n=30*12, fv=0 |

front 112 You want to retire in 40 years with $1 million. Assuming you can earn 10% per year, how much should you deposit at the end of each year? | back 112 PMT=? $2,259.41@pv=0, FV=1M |

front 113 You want to retire in 40 years with $1 million. Assuming you can earn 10% per year, how much should you deposit at the end of each month? | back 113 FV= 1M, N=480, I/Y=10/12, PV=0-> PMT=-158.13; ->@FV=0, PV=-18,621.74, pmt= 158.13 |

front 114 You have $1,000 to invest now. How long will it take to achieve your goal of $1,800 if you earn 8%? | back 114 7.64 years Mathematically: FV/PV = (1 + i)n Take 1n of both sides N=ln(FV/PV)/ln(1+i) |

front 115 You can set aside $500 per year at 12%, how long until you obtain $100,000? | back 115 28.40 years Mathematically: FV/PV = (1 + i)n Take 1n of both sides N=ln(FV/PV)/ln(1+i) |

front 116 You borrow $15,000 from your cousin at 7%. He says you can pay him back $1,200 per year. How long will it take to pay off the loan? | back 116 30.73 years pv=+15000, pmt=-1200, fv=0 Mathematically: FV/PV = (1 + i)n Take 1n of both sides N=ln(FV/PV)/ln(1+i) |

front 117 Suppose you can take a penny and double your money every day for 30 days. What will you be worth? | back 117 Iper=100%, n=30, pv=-.01, pmt=0, Fv = $10,737,418.24 |

front 118 Suppose you plan to retire in 40 years and must choose between two options. Both options earn 11% per year. Which makes the most money (and how much)

| back 118

|

front 119 Suppose you plan to retire in 40 years and you earn 11% per year. You make 10 annual payments beginning in one year and then make no more payments. You let your money ride for the remaining 30 years. What would your annual payments need to be so you could retire with $1 million? | back 119 Work backwards! Need $43,682.82 after 10 years {FV2=1M, I/Y=11, N=30, PMT2=0 -> PV2=? = FV1 Now, N=10, PV1=0, FV1 = 43,682.82 , PMT1=?Annuity payment: $2,612.29 |

front 120 For a $100,000 mortgage, @ 10% annual rate with 30 equal annual payments. What is the effective interest if there is a 2% [2 points] loan origination fee, processing expenses etc.? | back 120 Calculate PMT=-10,608, [fv=0, n=30, pv=100,000] Now enter pv=98,000, CPT, i/y= 10.24%, [because PMT remains same] Now enter pv=-2,000,i/y=10, fv=0, CPT PMT= 212 FV of 212 @10% over 30 yrs = $34,898 |

front 121 Find the FV and PV of a 3% sales load and $1500 flat annual fee on a $100,000 initial investment over 10 years assuming a 10% annual return. See yahoo screener. | back 121 pv=-3000, pmt=-1500, i/y=10, n=10, FV=$31,687 With PMT=0, this is equivalent to PV =-12,217 |

front 122 An annuity whose payments occur at the end of each period is called:

| back 122 B |

front 123 If you deposit $12,000 per year for 16 years (each deposit is made at the beginning of each year) in an account that pays an annual interest rate of 15%, what will your account be worth at the end of 16 years?

| back 123 ? Slide 2-53 |

front 124 _________ is he amount of annual interest income provided by the bond. Detailed on bond. | back 124 Coupon |

front 125 _________ is the chance that issuer of bond will fail to make scheduled payment | back 125 Default risk |

front 126 What would happen to the value of a very safe bond if market interest rates increase? | back 126 It would drop. Ratings only reflect default risk, not interest rate risk and other risks. |

front 127 _______ bonds: Issued with no (or a low) coupon rate and sold at a deep discount from par | back 127 Zero (or low) coupon |

front 128 ________ Bonds: Rated Ba or lower and often used to finance mergers and takeovers; high risk bonds with high yields | back 128 Junk |

front 129 _______ bonds: Can be redeemed at par at the holder ’ s option at specific dates or if the firm takes specific actions | back 129 Putable |

front 130 A $1,000 par value bond quoted at 96 has a price of _____ | back 130 $960 |

front 131 A $1,000 par value bond quoted at 102.5 has a price of ______ | back 131 $1,025 |

front 132 What is the value of a 10-year, 10% annual coupon bond, if rd = 10%? | back 132 $1,000 Chapter 7, slide 7-22 and 7-23 |

front 133 There is a 10-year, 10% annual coupon bond, with rd = 10%? Suppose you just bought this bond this morning for $1,000 when the market rate was 10%.

| back 133

|

front 134 Assume you bought a 10-year, $1,000 par bond with $100 annual coupon payments this morning for $1,000 when market rates were 10%.

| back 134

|

front 135 The shorter the amount of time until maturity, the ______(more/less) responsive a bond's market value is to changes in required return | back 135 less |

front 136 Suppose you have two bonds. Both bonds have $1,000 par values and pay 10% annual coupons, but one bond has 1 year remaining until maturity and the other has 10 years. If the yield curve is flat and the market interest rate for both bonds is 10%, what will the bonds sell for? | back 136 $1,000 each |

front 137 Which has more interest rate risk, long-term or short-term bonds? | back 137 All things equal, long-term bonds are more sensitive to interest rate changes than short-term bonds. For an equal interest rate change, l-t bond prices will change considerably more than short-term prices. |

front 138 If you think interest rates will be dropping, would you rather be holding long-term or short-term bonds? | back 138 long-term |

front 139 Bond prices and interest rates are ______ (directly/inversely) related | back 139 inversely |

front 140 A bond that sells for less than par is known as a ________. | back 140 discount bond |

front 141 A bond will sell at a discount whenever the coupon rate is _______ (greater/less) than market rate. | back 141 less than |

front 142 A bond that sells for more than par is known as a premium bond and its coupon rate is ______ (greater/less) than market rate. | back 142 greater |

front 143 Assume you just bought a 5-year, $1,000 par bond with $100 annual coupon payments this morning when market rates were 8% for $1,079.85.

| back 143 (premium bond – why? Because coupon rate =10%)

|

front 144 As maturity approaches, bond values approach ______. | back 144 par As a bond approaches maturity, its value will approach par, regardless of whether it is selling at a premium or a discount |

front 145 Discount bonds will ______ (increase/decrease) in value as maturity approaches | back 145 increase |

front 146 Premium bonds will ______ (increase/decrease) in value as maturity approaches. | back 146 decrease |

front 147 _________ risk is the chance that cash flows have to be reinvested at an interest rate lower than what was initially being yielded. | back 147 Reinvestment |

front 148 Which has more reinvestment risk, long-term or short-term bonds? | back 148 Short-term -> principal handed back |

front 149 Suppose you have a 20-year investment horizon:

| back 149

Although 1 year bonds have little interest rate risk, they have more reinvestment risk |

front 150 True or False: All 10-year bonds have the same price and reinvestment rate risk. | back 150 False! Depends on coupon level -> Low coupon bonds have less reinvestment rate risk but more price risk than high coupon bonds. |

front 151 Long-term bonds: _____ (high/low) interest rate risk, ______ (high/low) reinvestment rate risk – for principal | back 151 High interest rate risk, low reinvestment rate risk (however the coupon payments are still exposed to the prevailing interest rates). |

front 152 Short-term bonds: _____ (high/low) interest rate risk, ______ (high/low) reinvestment rate risk – for principal | back 152 Low interest rate risk, high reinvestment rate risk |

front 153

| back 153

Chapter 7, slide 7-37 |

front 154 _______ is the rate of return investors expect to earn if they buy a bond at a specific price and hold it until maturity | back 154 Yield To Maturity (YTM) |

front 155 What is the YTM on a 10-year, 9% annual coupon, $1,000 par value bond, selling for $887? | back 155 10.97% This bond sells at a discount, because YTM > coupon rate. Chapter 7, slide 7-38, 7-39 |

front 156 Find YTM, if the bond price was $1,134.20. | back 156 7.08% This bond sells at a premium, because YTM < coupon rate. Chapter 7, slide 7-40 |

front 157 Find the current yield and the capital gains yield for a 10-year, 9% annual coupon bond that sells for $887, and has a face value of $1,000. If market conditions stay the same, what will the price of our bond be in one year? | back 157 CY = 10.15% CGY = 0.76% Chapter 7, slide 7-44, 7-45 |

front 158 What is the value of a 10-year, 10% semiannual coupon bond, if kd = 13%? | back 158 ? $834.72 Chapter 7, Slide 7-48 |

front 159

| back 159

Chapter 7, Slide 7-49 and 7-50 |

front 160 Is a AAA rating a protection from a drop in value of bond? | back 160 What would happen to the value of a very safe bond if market interest

rates increase? |