Shift factors

- Technology

- Availability of resources

Other

- Straight line: Constant opportunity cost

- Bowed out: Increasing opportunity cost

PPC

- binding must be below equilibrium

- quantity demanded is greater than quantity supplied

- creates a shortage

- example rent control

Price cealing

- binding must be above equilibrium

- quantity supplied is greater than quantity demanded

- create a surplus

- example a minimum wage

Price floor

- queens over princesses

elasticity along a demand curve

- less elastic curve pays more tax

- perfectly in elastic puts tax all on producers

- perfectly elastic puts tax all on consumers

Supply and demand with Tax, CS, and PS

- will keep producing until price falls below avc

- area between avc and atc is the amount of fixed cost

- change in fixed cost moves atc only

- change in variable cost moves atc, avc, and mc

Cost curves

- economies of scale, constant returns to scale, diseconomies of scale

- monop comp in the long run is producing in economies of scale

LRATC

- price taker

- product is identical and has perfect substitutes

- when profit is made in the short run firms enter (no barriers to entry)

- zero economic profit in the long run

- both productively efficient and socially optimal in the long run

Perfect competition

- high barriers to entry

- unique product

- price maker

- produces in the elastic region of the graph

- not productively efficient or socially optimal

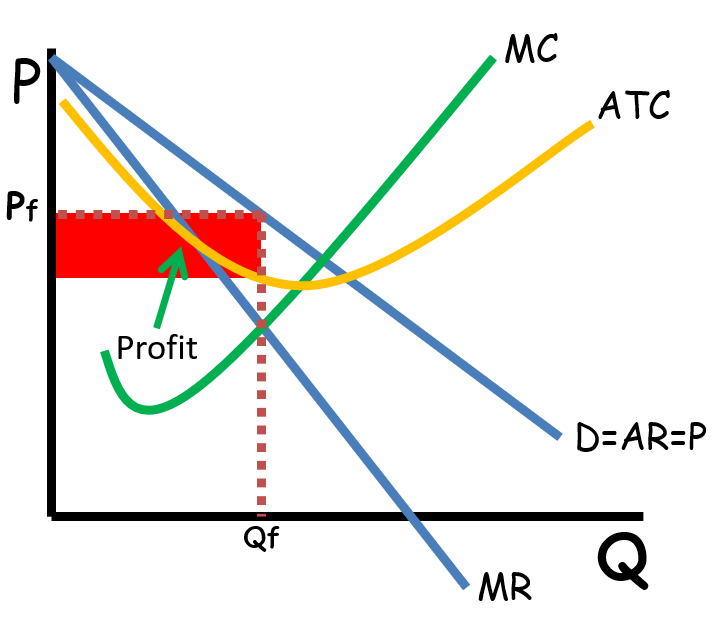

monopoly

- d and mr are the same

- there is no CS or DWL

price discriminating monopolist

- when demand intersects atc while demand is downward sloping

- government can regulate (at socially optimal quantity with a price cealing)

- firm would need a lump sum subsidy (atc would be greater than price)

natural monopoly

- atc touches but does not cross darp line

monopolistic competition in long run equilibrium

- differentiated product

- some control over price

- when profit is being made firms will enter (no barriers to entry)

- demand for the firms product increases when firms leave the market and decreases when firms enter

- zero economic profit in the long run

- LRATC tangent at Q1 in long run

- not productively efficient or socially optimal

monopolistic competition in short run profit

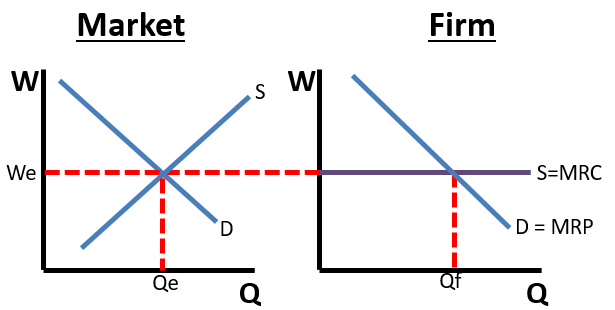

- firms are wage takers

- sometimes just a shift in mrp

- hire where mrp= mfc

- min wage results in less workers hired

perfectly competitive labor market

- wage maker

- mfc curve is above the supply curve

- mfc doesn’t equal wage

- firm will hire additional labor as long as mrp is greater than mfc

- hires fewer workers than a perfectly competitive labor market

monopsony

- good is overproduced in the market

- msc> mpc

- cost to society is higher than the individual firm

- needs a per unit tax on producer to be socially optimal

negative production

- good is underproduced in the market

- msb>mpb

- benifit to society is higher than the benefit for the individual firm

- needs a per unit subsidy on consumer to be socially optimal

positive consumption

4 dots

- profit maximizing mc=mr

- socially optimal mc=d

- fair return atc=d

- revenue maximizing point where mr crosses q axis

elasticity

queens/ princesses

price elasticity of demand ed>1

%change in quantity demanded/%change in price

cross price elasticity of demand

% change in demand/ % change in p of related good

substitutes

e cross price > 0 positive number

complements

e cross price < 0 negative number

income elasticity of demand

% change in demand/ % change in income

normal goods

e income > 0 ppl will spend more on these when their income rises

inferior goods

e income < 0 ppl will spend less on these when income rises

Total revenue

p x q

price elasticity of supply es>1

%change in quantity supplied/ %change in price

utility maximizing rule

MUx/Px = MUy/Py

Fixed costs

constant, exists at zero output

Variable costs

change as output changes

Total costs

Fixed costs+ variable costs

Marginal cost

Change in TC (change in TC/ change in Q)

MPP

change in total product/ change in quantity of labor

MRP

Output x MPP

hire where mrp is greater than or equal to mfc